VAT & Customs for yachting

All our solutions to offer you a service adapted to the tax and customs obligations of a yacht in the European Union.

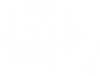

Purchase of a pleasure yacht in the European Union (intra-community acquisition)

An individual or a company purchasing tax free a new or second-hand vessel in the European Union, must obtain a VAT paid certificate after having paid it.

The buyer contacts EASYTAX INTERNATIONAL

EASYTAX INTERNATIONAL:

- Analyzes the fiscal situation of the vessel

- Determines and collects the mandatory documents before the arrival of the vessel in France

- Determines, together with the tax authorities and the shipowner, the place where the VAT paid certificate is obtained.

- Takes care of registering the company for VAT, if applicable.

- Contact the tax authorities to obtain a VAT paid certificate

- Request payment of VAT (if required).

In case of planned commercial activity, EASYTAX INTERNATIONAL will send the yacht manager and the captain the procedures to follow, the models of contracts, expense reports (APA), Trip report, Navigation report and finally the VAT Guidelines for the countries concerned.

EASYTAX validates the “VAT paid” status and sends the tax certificate to the new yacht owner.

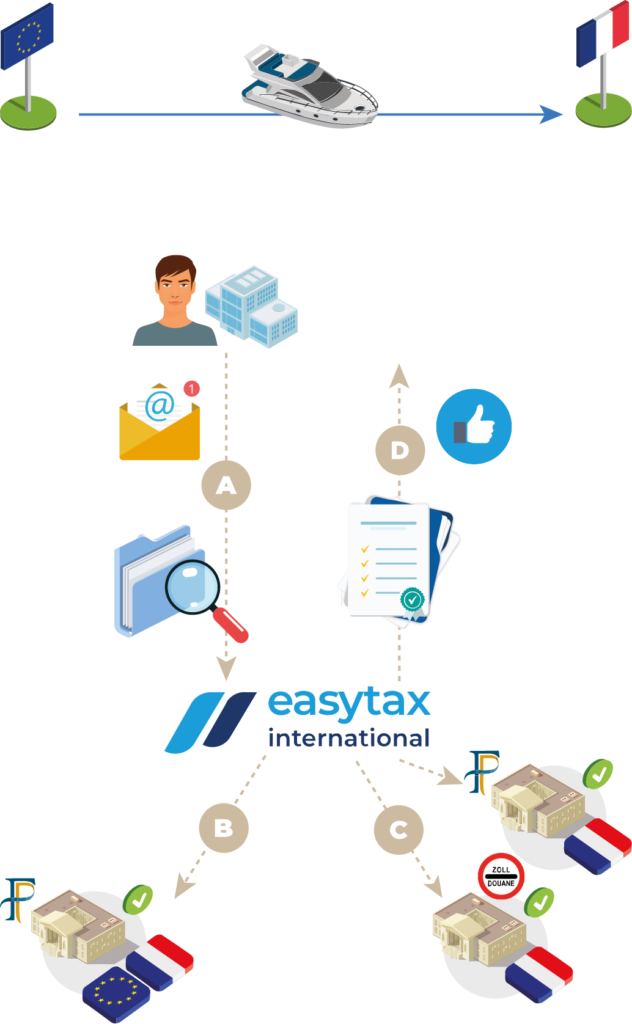

Exporting a vessel

An individual or a company that wishes to position its vessel outside the European Union for a short or long period of time must make a customs declaration and obtain a Single Administrative Document (SAD) Export.

The captain or yacht manager contacts EASYTAX INTERNATIONAL.

EASYTAX INTERNATIONAL:

- Indicates which documents are required and collects them.

- Contacts the customs authorities for the export application.

- Determines the departure location and dates with the customs authorities and vessel’s owner.

- Files the customs declaration.

EASYTAX INTERNATIONAL sends the captain and/or the yacht manager the Export Single Administrative Document (SAD).

The vessel is considered as exported by the Customs Authorities.

Please note: proof of arrival in a port outside the European Union is mandatory.

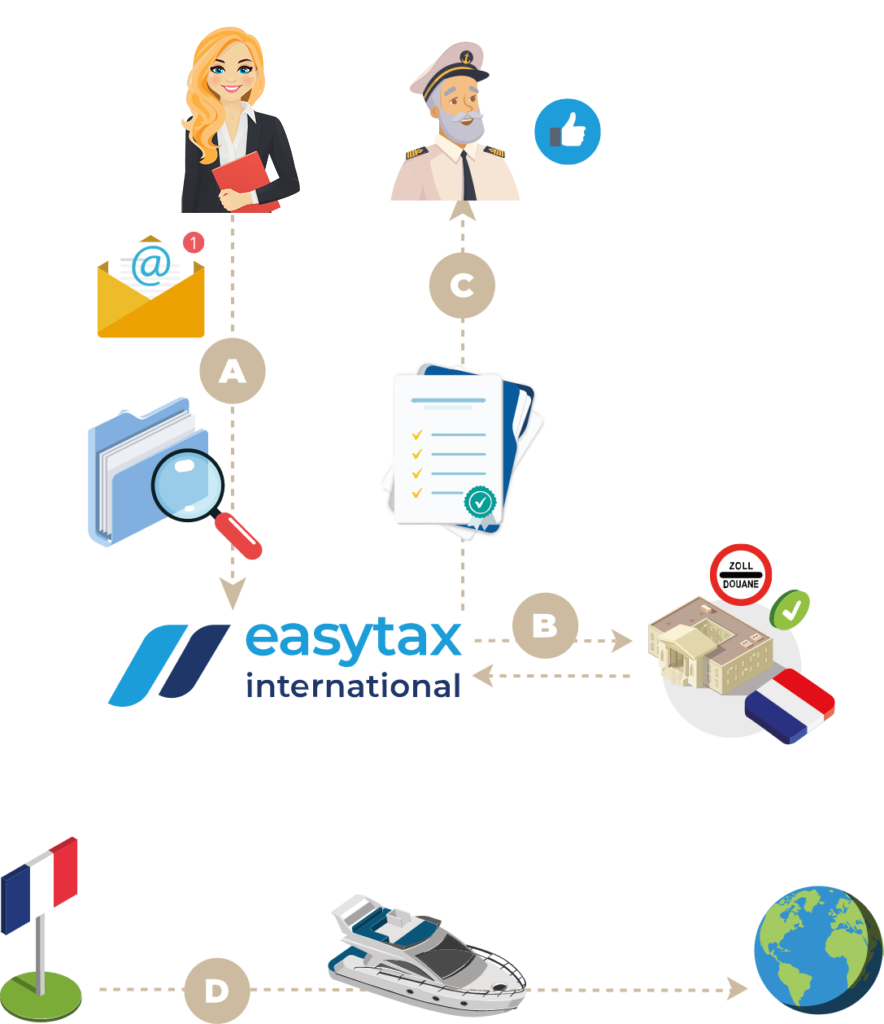

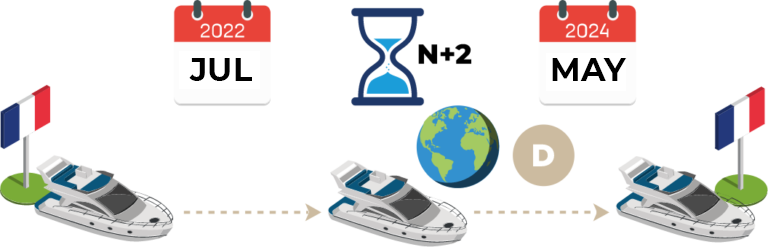

Export/import of a pleasure yacht under returned goods relief

A pleasure yacht that has been acquired “VAT paid” in the European Union can benefit from the “returned goods relief” to cruise waters outside the European Union and then return to EU waters.

This type of vessels must obtain a customs export document to stay out of EU waters for a maximum period of three years, before being re-imported in order to avoid paying duties and taxes when re-importing the yacht into EU waters.

The captain or the yacht manager contacts EASYTAX INTERNATIONAL

EASYTAX INTERNATIONAL

- Indicates which documents are required to export the vessel and collects them.

- Contacts the customs authorities to set up the “returned good relief”.

- Selects the customs office for export.

- Ensures the customs declaration is filed.

EASYTAX INTERNATIONAL passes the validated export declaration to the vessel.

The captain or yacht manager contacts EASYTAX INTERNATIONAL. To return the vessel to the European Union.

EASYTAX INTERNATIONAL

- Indicates which documents are required to re-import the vessel, collects them and contacts the customs authorities to set up the “returned-goods system“.

- Selects the customs office for re-import.

- Ensures the customs declaration is filed.

EASYTAX INTERNATIONAL sends the validated re-import declaration to the vessel. The pleasure yacht keeps its “VAT paid” status because it has returned to the European Union within 3 years.

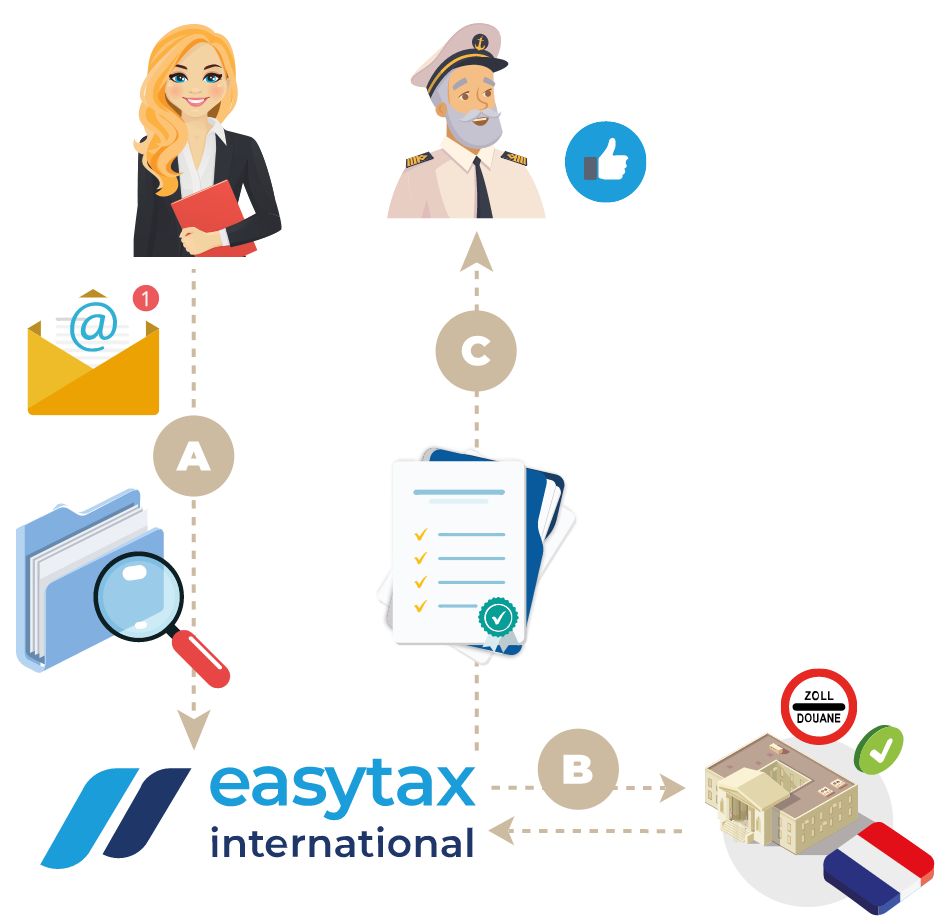

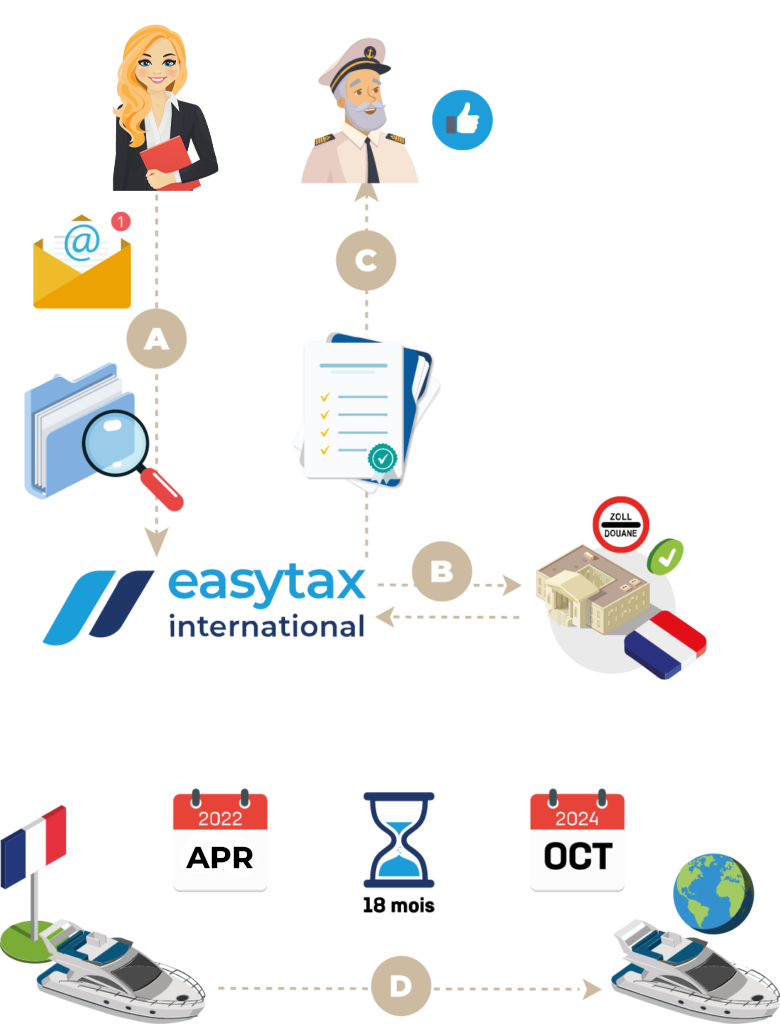

The 18-month temporary admission scheme

When a pleasure yacht flying the flag of a non EU country and owned by a legal or natural person established in a country outside the European Union wishes to sail in the waters of the European Union, it can stay there for a period of 18 months without paying VAT on the hull. However, in the event of an inspection by the authorities, this vessel will have to prove that it has the right to sail in the European Union without having to pay VAT.

This scheme can be secured by a TA-18 paperwork (DAV) that formalizes the start date of the 18 months.

The captain or the yacht manager asks EASYTAX INTERNATIONAL to draw up a TA-18 paperwork (DAV).

EASYTAX INTERNATIONAL:

- Indicates which documents are required and collects them.

- Contacts the customs authorities.

- Files the customs declaration.

EASYTAX INTERNATIONAL sends the captain and/or the yacht manager the TA-18 paperwork (DAV).

The pleasure yacht remains in France/the EU for a maximum of 18 months and leaves EU waters for a country outside the EU before the end of the 18 months.

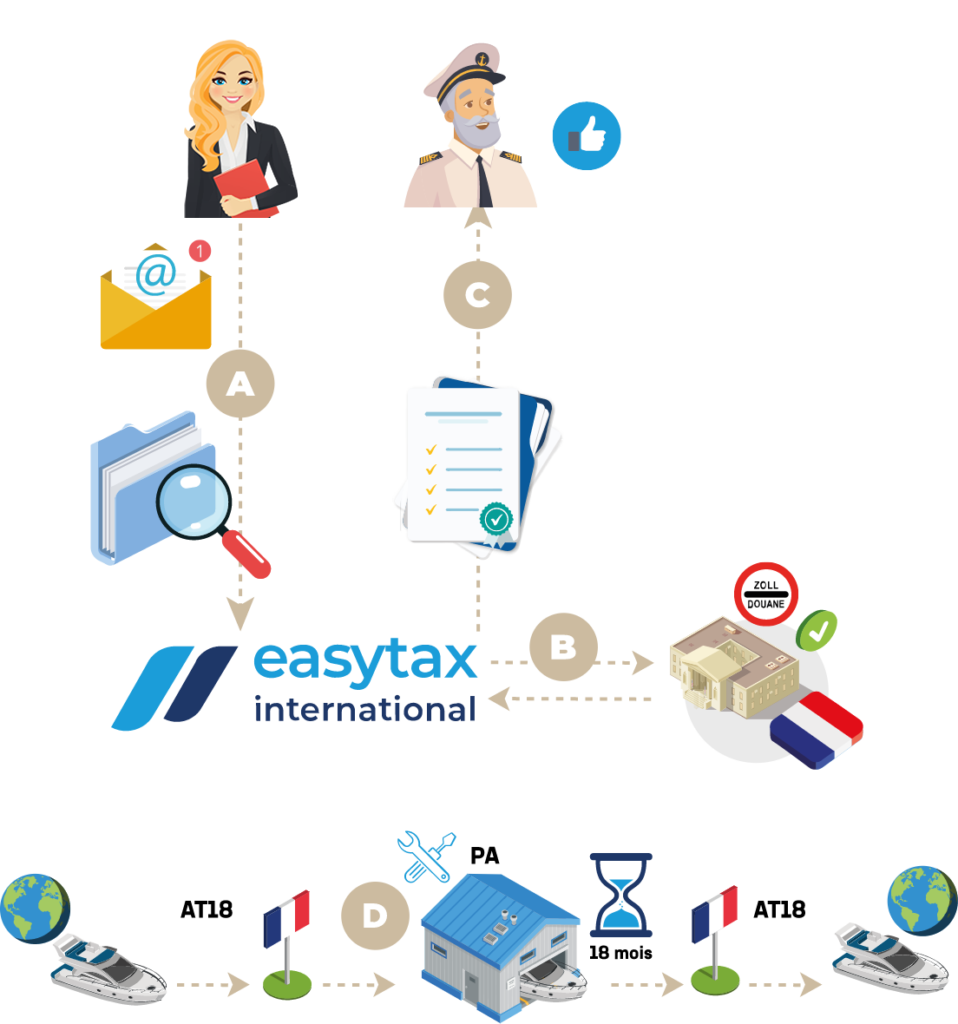

Repairing a yacht under Inward Processing Relief during an 18-month temporary admission.

A pleasure yacht can benefit from VAT-free repairs with the implementation of Inward Processing Relief arrangments. The 18-month Temporary Admission (TA18) is suspended during the time spent at the shipyard.

The captain or the yacht manager contacts EASYTAX INTERNATIONAL to set up Inward Processing Relief.

EASYTAX INTERNATIONAL

- Indicates which documents are required and collects them.

- Contacts the customs authorities to request authorization and file an import declaration.

EASYTAX INTERNATIONAL sends the validated declaration to the yacht manager/captain.

Once the repairs are completed, EASYTAX INTERNATIONAL files a re-exportation declaration for the yacht which regains its Temporary Admission 18-month status.

The total duration of a vessel’s stay in the European Union (temporary admission 18 months + inward processing relief) is 24 months.