VAT representation for vessels, yachts and boats

A foreign shipowner who charters in EU waters is required to appoint an agent or fiscal representative to carry out all reporting formalities. EASYTAX INTERNATIONAL is here to help, before, during and after the season.

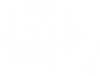

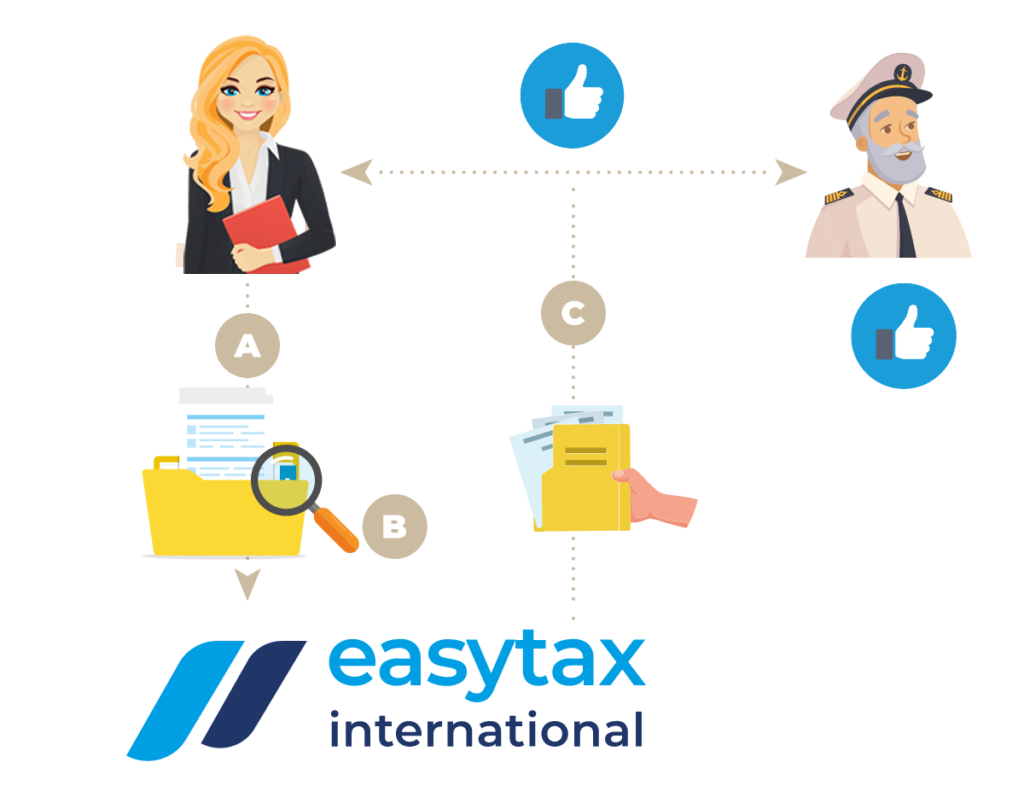

Preparing for the arrival of a yacht

The yacht manager / captain sends EASYTAX INTERNATIONAL a request to integrate a new vessel.

EASYTAX INTERNATIONAL analyzes the situation of the vessel (history of the yacht, VAT and customs status) and indicates if any obligations are necessary (e.g. import).

EASYTAX INTERNATIONAL sends the yacht manager and the captain the procedures to follow, the models of contracts, expenses reports (APA), “Trip report”, “Navigation report” and finally the “VAT Guidelines” for the countries concerned.

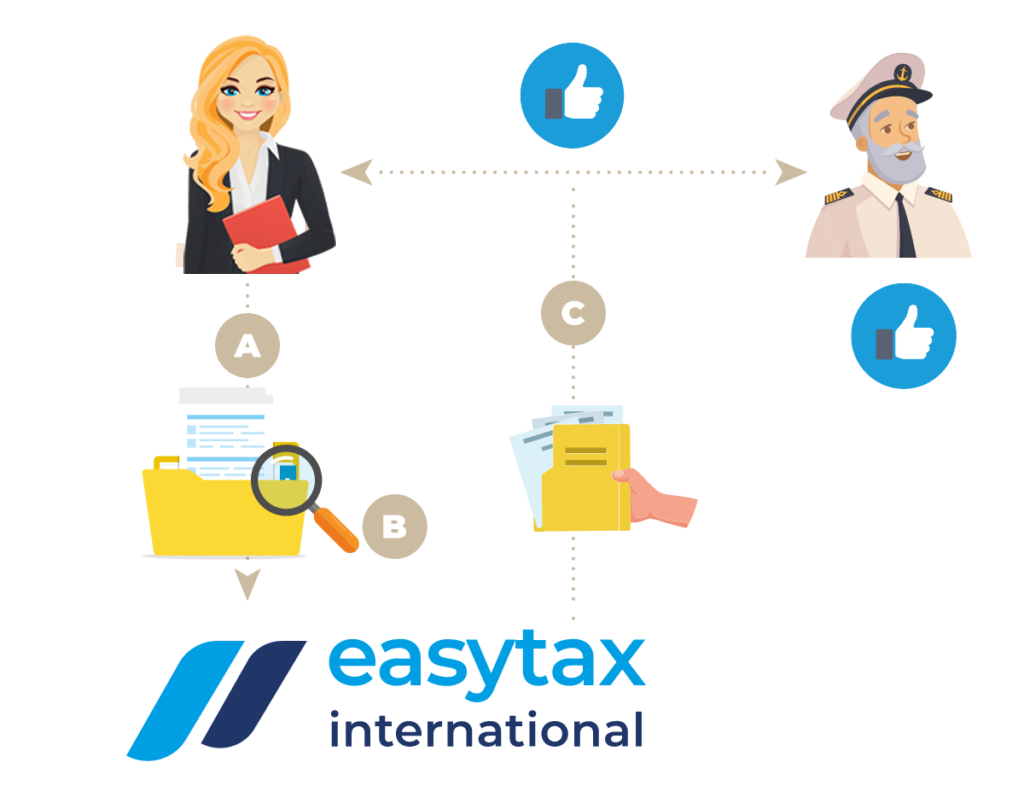

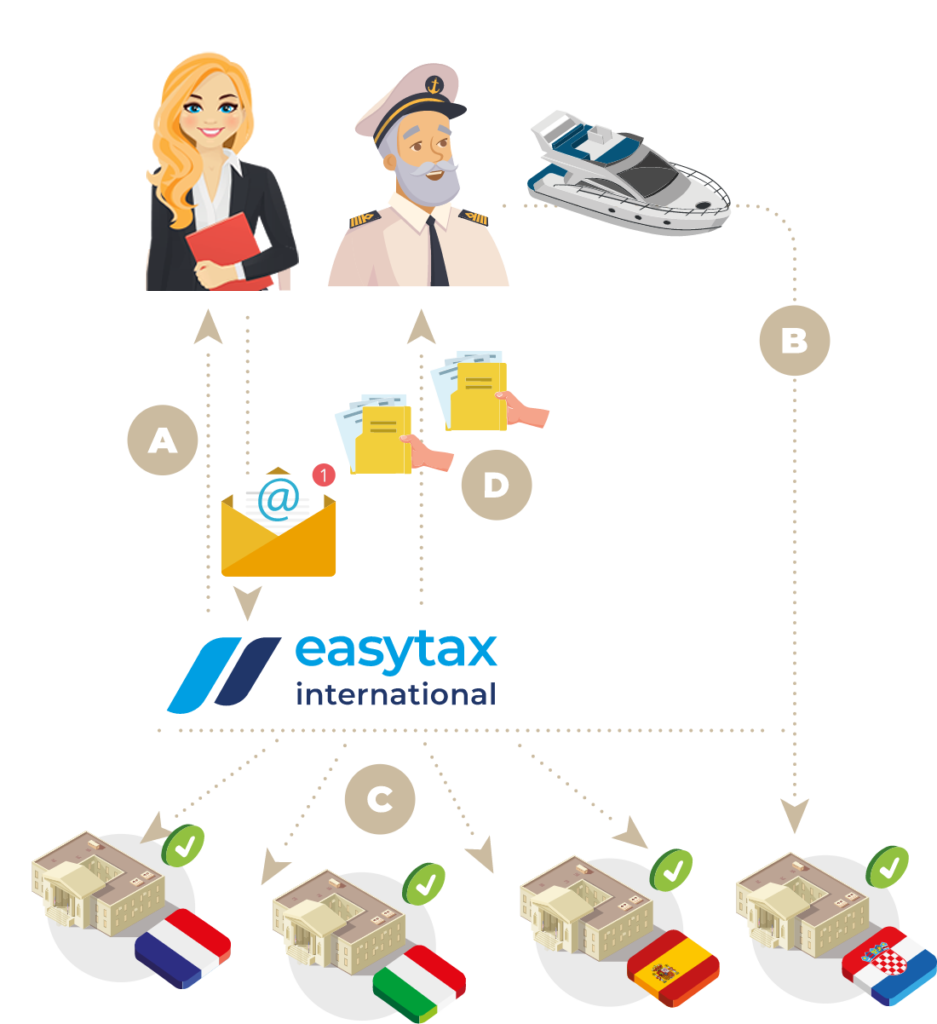

VAT registration

EASYTAX INTERNATIONAL ensures the shipowning company is registered for VAT in the necessary countries.

EASYTAX INTERNATIONAL sends the VAT numbers to the yacht manager and captain.

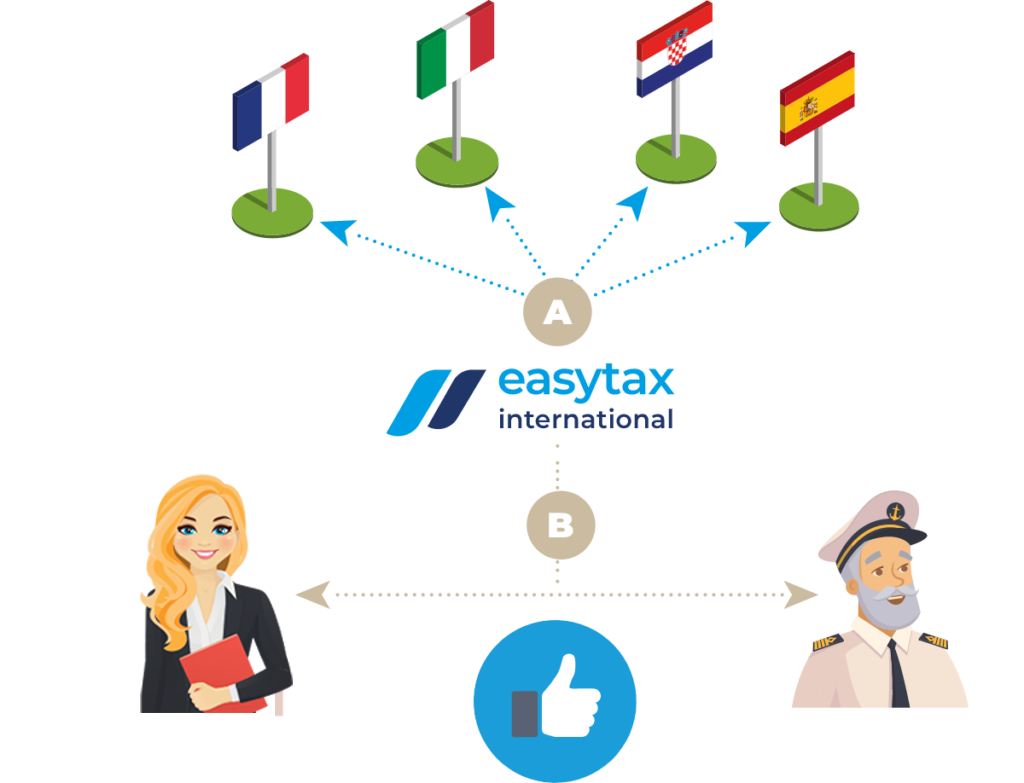

Import of the vessel in the European union (if necessary)

EASYTAX INTERNATIONAL indicates and collects the mandatory documents from the yacht manager / captain.

Upon receipt of the documents, EASYTAX INTERNATIONAL makes the import request to the relevant customs authorities, chooses the VAT regime and the customs office and works with the captain to decide when the day of import will be.

As soon as the yacht arrives, EASYTAX INTERNATIONAL files the customs declaration and sends the validated declaration to the captain and yacht manager.

The vessel can circulate freely within the European Union.

VAT compliance analysis at the signing of a new charter or transport contract

The yacht manager informs EASYTAX INTERNATIONAL when a new contract is signed.

EASYTAX INTERNATIONAL analyzes the contract, schedules VAT and proof requests, and solicits additional information in case of anomalies or questions.

EASYTAX INTERNATIONAL validates the charter contract / passenger transport contract and, if necessary, sends the yacht manager requests for additional information.

Declaration and payment of VAT on charter or transport contracts

EASYTAX INTERNATIONAL will ask the yacht manager / captain to collect the documents (APA reports, proof of navigation, etc…)

EASYTAX INTERNATIONAL analyzes the elements and sends the yacht manager/captain the VAT payment request.

EASYTAX INTERNATIONAL interacts with the tax authorities and then transmits to the yacht manager and the captain the copy of the VAT declaration, the proof of payment of VAT, the invoice of the charter or transport service.

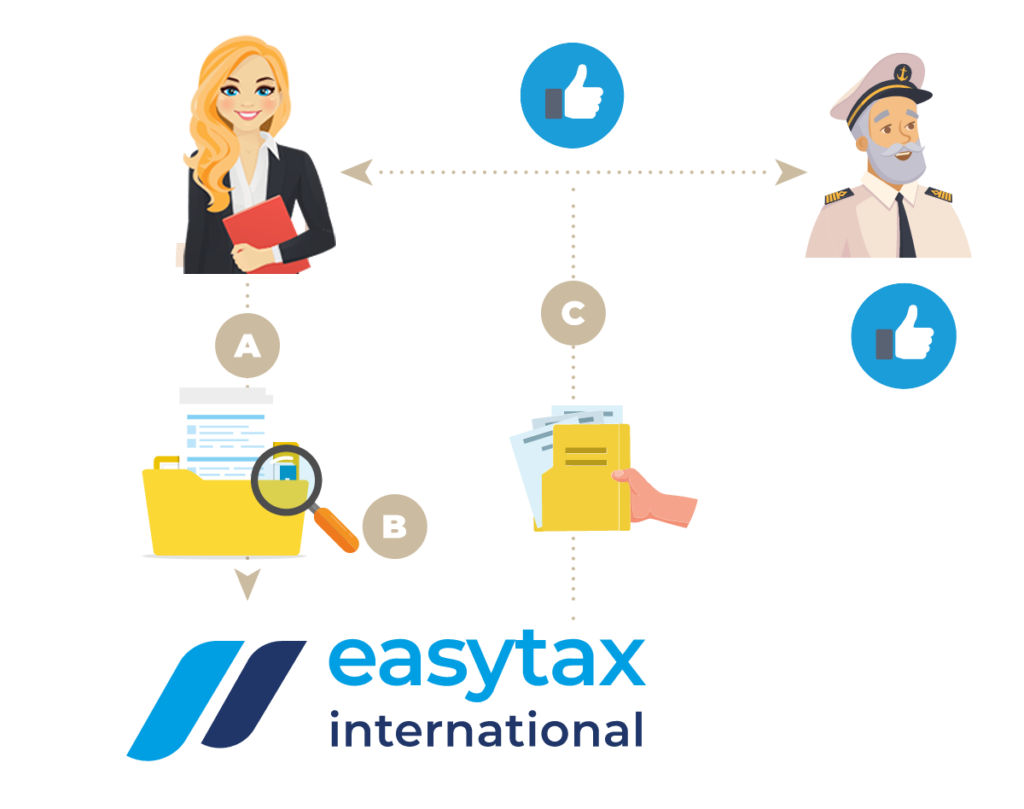

Validating the season’s activity

EASYTAX INTERNATIONAL, at the end of the season, requests the “trip report” from the yacht manager and/or the captain.

The yacht manager and/or the captain send the completed Trip Report to EASYTAX INTERNATIONAL.

EASYTAX INTERNATIONAL sends the yacht manager / captain the results of its analysis of the vessel’s VAT status.

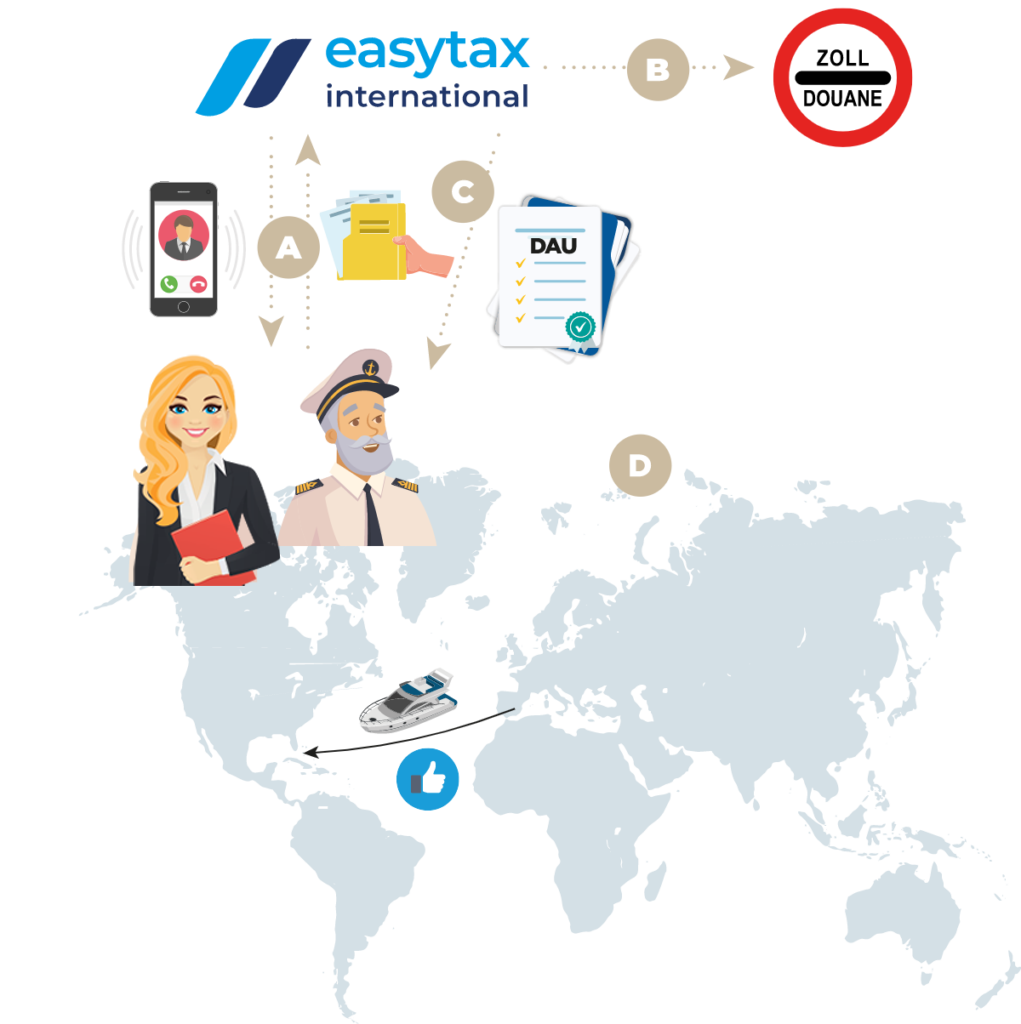

Export of the vessel outside Europe (if necessary)

The captain or the yacht manager requests the export of the yacht. EASYTAX INTERNATIONAL will let the yacht manager know which documents are required and collects them.

EASYTAX INTERNATIONAL makes the export request to the relevant customs authorities, chooses the customs office, works with the captain to decide the day and place of departure, and files the customs declaration.

EASYTAX INTERNATIONAL passes the Export Single Administrative Document (SAD) to the vessel. The vessel is now free to leave the European Union.